By Jim Rugg, Head of Replenishh

As someone who drives a company electric vehicle, I am very much looking forward to 2020. Not only because I know how quickly the EV charging infrastructure will grow in the UK this year, and how much I will continue to save on charging my car as opposed to filling up on petrol or diesel (and all the associated price fluctuations).

It is also because from April I will be paying zero BIK tax.

If you have ever driven a company or fleet car you will know what Benefit in Kind (BIK) tax is, and how much difference it could make to the cost-effectiveness of a vehicle. As a company car is considered a perk to an employee it is eligible for tax. This is calculated at the rate of a percentage of the vehicle’s list price and its CO2 emissions. Until recently this figure stood at 16% for Electric Vehicles which on an average fleet or company car could still amount to over £1000 per year.

But last summer HMRC took the decision to reduce the BIK tax rate to 0% from 6 April this year.

This is not just a short term gimmick, as the government also announced that the rate of BIK will stay low for the foreseeable future. It will only rise by 1% for each of the next two years so will be 2% by 2022-23.

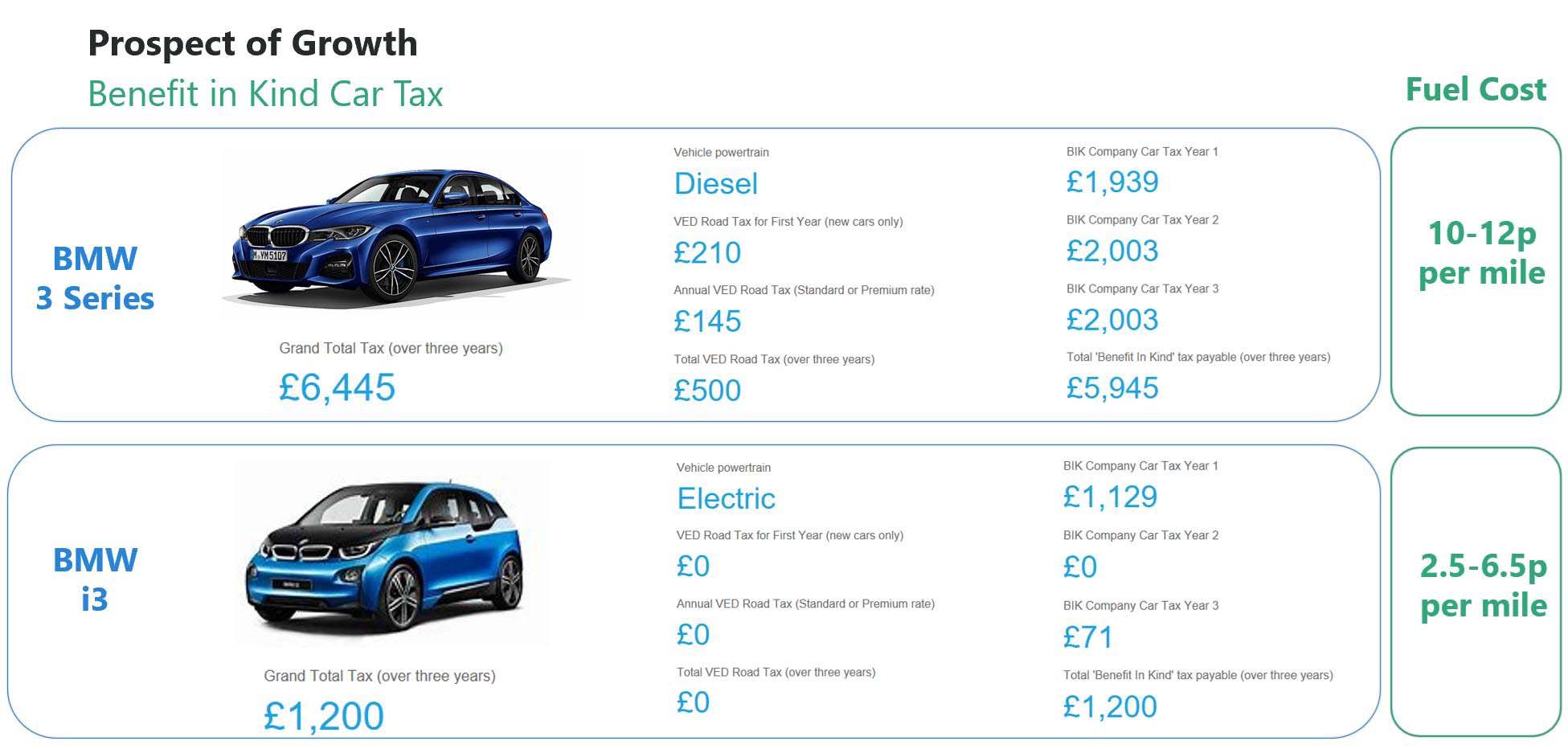

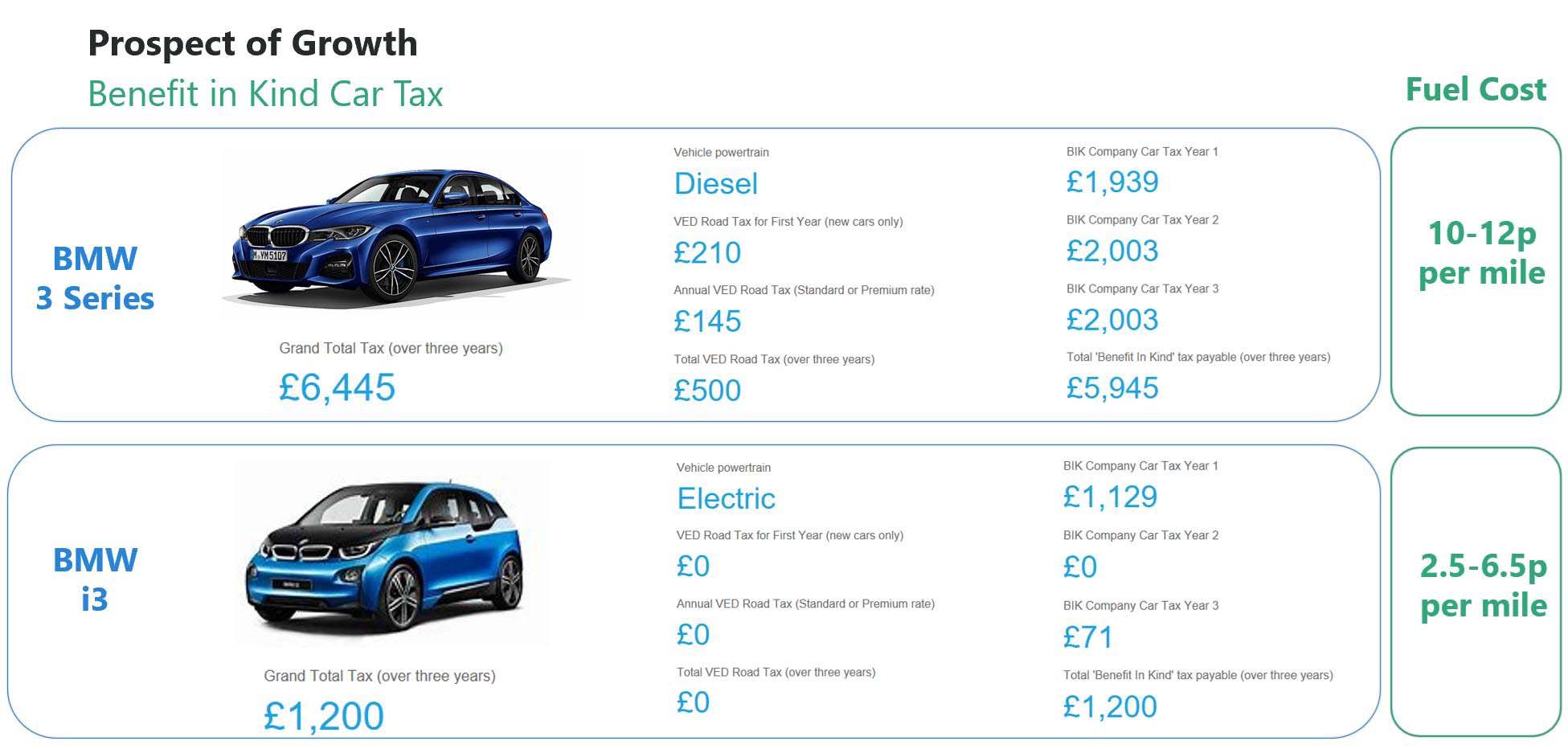

I drive a BMW i3, and as you can see below, from 2019-22 I will be saving £4,745 in road tax (in just three years) and BIK tax compared to someone driving a BMW 3 Series.

These rates apply to all EVs registered after April 6 2020, including those vehicles with CO2 emissions of between 1-50 g/km and a range of over 130 miles. For EVs registered before April 6 2020 there is a different rateable scale, but pure EVs with zero CO2 emissions still qualify for the zero rate this year and the low rates in 2021 and 2022.

If you are a company car owner like me this is very good news, but what does it mean for fleet managers?

Fleet managers are bound to have their employees queuing up requesting a switch to EVs. But aren’t they a lot more expensive? Well, at the moment broadly they are, but as company cars account for 44% of all new EV registrations in Europe, they represent a huge factor in the drive to reduce the UK’s emissions to net zero by 2050. They will inevitably come down in price.

When it comes to running costs, there is no comparison. EV’s cost around 4p per mile to charge, compared to around 8-9p for petrol and 10-12p for diesel. With fewer engine and moving parts the maintenance costs of an EV are significantly lower. Start-up subsidies such as the Plug in Car Grant (which removes £3500 from the list price of a qualifying EV and up to £8000 for a van) add a further incentive.

Then there are the PR benefits of becoming an electric fleet to consider. What could be better than to be at the forefront of the EV revolution, to have your drivers arrive at clients’ premises in their environmentally clean vehicles. Perhaps even asking where they can charge up?

Ultimately fleet managers will want happy drivers.

How do fleet managers make the switch to EV?

In my role I can help any fleet manager or consultant make the switch to EV. At Replenishh we offer a range of EV charging installation services:

- Our installers serve Home, Business or Public locations

- From single domestic charging stations to multi-point hubs

- Advice on load management systems

- Implement back office & payment systems

- Choose from over 2,000 products, including charging stations, cable & switchgear

Contact me today for a no-obligation chat about your EV options.

Email:

jim.rugg@replenishh.com

Tel: 01206 835538

These rates apply to all EVs registered after April 6 2020, including those vehicles with CO2 emissions of between 1-50 g/km and a range of over 130 miles. For EVs registered before April 6 2020 there is a different rateable scale, but pure EVs with zero CO2 emissions still qualify for the zero rate this year and the low rates in 2021 and 2022.

These rates apply to all EVs registered after April 6 2020, including those vehicles with CO2 emissions of between 1-50 g/km and a range of over 130 miles. For EVs registered before April 6 2020 there is a different rateable scale, but pure EVs with zero CO2 emissions still qualify for the zero rate this year and the low rates in 2021 and 2022.  Then there are the PR benefits of becoming an electric fleet to consider. What could be better than to be at the forefront of the EV revolution, to have your drivers arrive at clients’ premises in their environmentally clean vehicles. Perhaps even asking where they can charge up?

Then there are the PR benefits of becoming an electric fleet to consider. What could be better than to be at the forefront of the EV revolution, to have your drivers arrive at clients’ premises in their environmentally clean vehicles. Perhaps even asking where they can charge up?

Post a Comment